Without a bank account, it is almost impossible to participate in social life. Rent, electricity, telephone and internet are usually paid cashless via a bank account. Salary payments are also transferred to your own bank account. Most banks in Germany require a permanent residence to open an account – the basic account is the exception here!

With a low-cost basic account, Chancenkarte holders can secure their day-to-day living expenses and make important payments without having to provide proof of permanent residence. The following blog article explains why it is important to open an account early and how to open a basic account.

Which account do I need as an Chancenkarte holder?

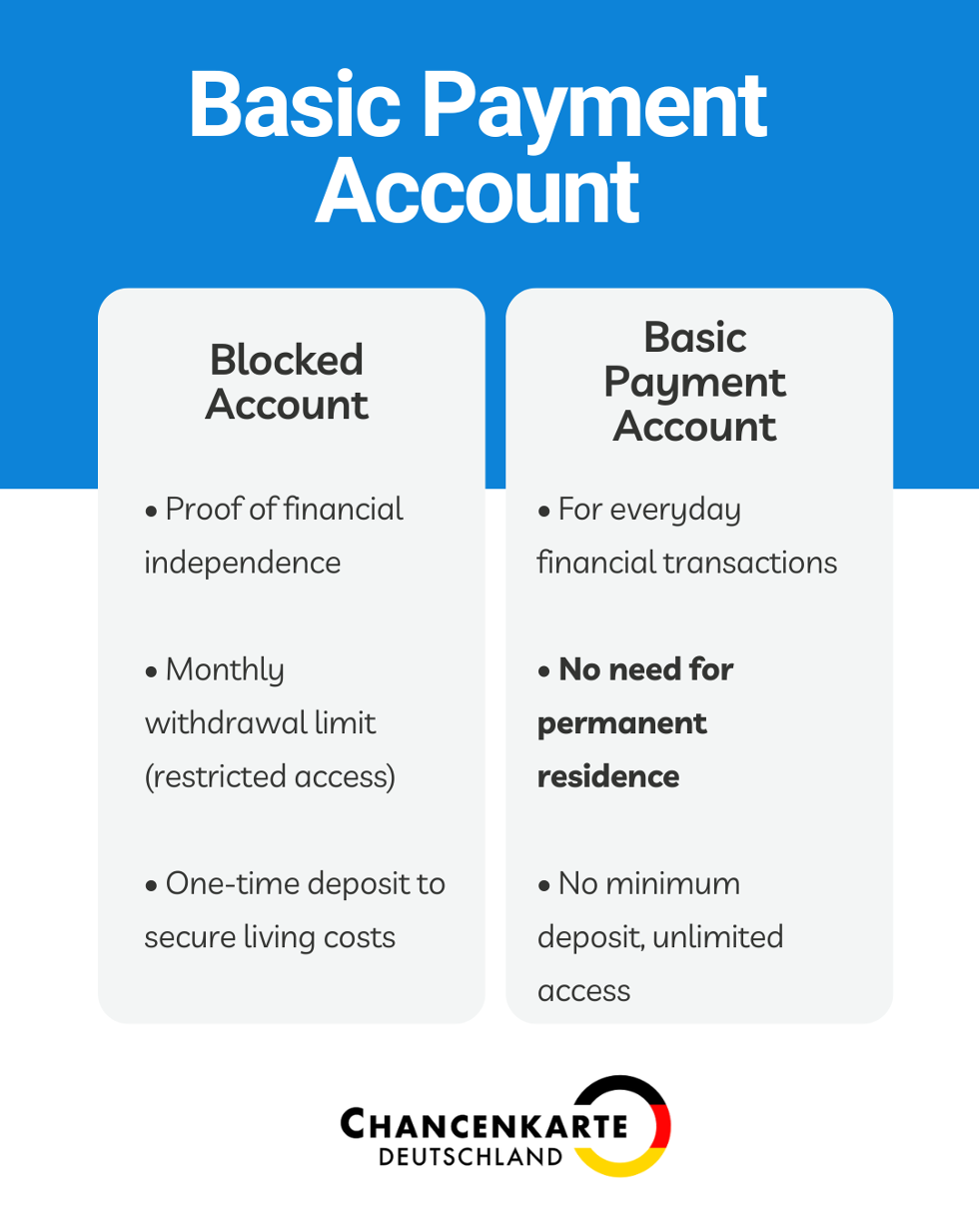

Chancenkarte holders first need a blocked account to prove their financial security. In addition, a basic account is recommended, which enables holders to carry out basic banking transactions such as direct debits, transfers and cash withdrawals without having to register a permanent residence.

What is the difference between a basic account and a blocked account?

Chancenkarte holders should apply for a blocked account before their stay in Germany in order to secure their livelihood. In most cases, you can open the account online. You must also specify a "blocked beneficiary“. This can be the respective diplomatic mission abroad or the responsible immigration authority. (The authority may not access the credit balance already deposited).

You must pay a certain amount of money into the blocked account. The required payment into your blocked accountdepends on the purpose of your stay. You can find the exact amount on the website of the responsible diplomatic mission or in the foreign portal (source: Federal Foreign Office).

Important: You may only withdraw a certain amount from your blocked account each month. This amount is fixed from the outset so that the balance deposited is sufficient for the entire period of your stay in Germany.

A basic account (low-cost current account) is recommended for daily payment transactions. This allows chip card holders to make transfers, card payments, set up direct debits or withdraw cash. To open a basic account, you must submit an application and prove your identity. Most banks make the application form available online. Basic Accounts are especially interesting for Chancenkarte holders without permanent residence.

Important: Every credit institution that offers payment accounts for its customers must also enable the creation of a basic account (source: Verbraucherzentrale).

How do I open a basic account?

Chancenkarte holders can choose a bank where they want to open a basic account. To do so, they must fill out a form and prove their identity (e.g. with a passport).

Because opening a bank account can generally take a long time, you should start in good time. After entering Germany, you can open a basic account. You will need this to pay your rent in Germany or to receive your salary

Documents required to open a basic account:

- Valid identity card / passport

- Proof of your stay (Chancenkarte)

- Proof of your income or your blocked account

Because banks earn less from a basic account than from a conventional current account, the application process can be complicated. Banks need to check your documents and ensure that you meet the requirements for opening a basic account. The bank must also ensure that the correct proof of your residence status is available to avoid misuse or incorrect applications. This often takes a lot of time, which you should allow for when opening your account

It is advisable to apply for the basic account at a local Volksbank or Sparkasse in person. This way, problems can be dealt with directly and the process of opening an account can be accompanied personally. Here you can find a local Sparkasse or a local Volksbank.

Conclusion

Opening a blocked account or a basic account can take a long time. Chancenkarte holders should therefore start the account opening process in good time. The account must meet statutory requirements. The relevant evidence and documents must be submitted in good time so that they can be checked.

It is often worth taking advantage of detailed advice before you open an account. With a personal consultation, you can quickly compile the documents you need to open an account, compare prices and avoid any misunderstandings. This saves you a lot of time, which you can then invest in finding suitable accommodation or in the further registration process for your stay in Germany, for example.

Chancenkarte Jobs!

With Chancenkarte Jobs! a job platform will soon be created here, bringing Chancenkarte candidates and jobs together. Register now to be among the first to access the platform.

Early Access to Chancenkarte Jobs!

Find jobs or candidates.

Enjoy exciting benefits for early users.